Part 2: Lightning Network, Bitcoin’s Crossing the Chasm Superpower

Before diving into this post, if you haven’t already, you should read Part 1: The Dual Adoption Curves of Bitcoin. That post explains how Bitcoin adoption can be understood by exploring its dual adoption curves in the context of the Diffusion of Innovations theory.

In this post, I’ll explain the concept of ‘Crossing the Chasm’ and hypothesize that the Lightning Network is Bitcoin’s Crossing the Chasm Superpower.

Crossing the Chasm

In the early 1990s, Geoffrey Moore studied the relationship between the burgeoning tech startup ecosystem and the Diffusion of Innovations theory. In his book, Crossing the Chasm, Moore posited a minor, yet enormously consequential, tweak to the Diffusion of Innovations theory. He hypothesized that between the early adopters and the early majority existed a massive gap, the chasm, which any technology needs to traverse to go mainstream. Otherwise, if a product could not cross the chasm, it would wither in the doldrums of its niche market and never reach full, mainstream adoption.

The Chasm exists because of the major psychological and social differences between early adopters and the early majority. Early adopters are visionaries searching for revolutionary change. They see a problem with the status quo and they actively want to adopt technologies to fix that. They are willing to take big risks to drive an order of magnitude change. On the other hand, the early majority are risk averse pragmatists who are focused on the day to day problems that exist within their specific vertical. They are searching for incremental, reliable solutions from established players. The early majority is not at all influenced by early adopters. Hence, the chasm…

Moore spends the rest of the book outlining the key strategies necessary to effectively cross the chasm. To briefly summarize, the key to crossing the chasm is relentless focus on one specific market segment, a beachhead. Moore says, “Target a specific market niche as your point of attack and focus all your resources on achieving the dominant leadership position in that segment.” Within that target market, you need to build out a “whole product.” A whole product includes the core product, but also, whatever you need to achieve your compelling reason to buy. This can include additional software, hardware, systems integration, installation and debugging, training and support, standards and procedures, etc. Early majority customers expect a product to just work for their use case. Once a dominant market position is achieved in this beachhead segment, the product can expand strategically into adjacent markets using the reputational gains from the initial segment to convince other members of the early majority.

Airbnb is one of the best examples of successfully crossing the chasm. Originally, Airbnb started as a service where people booked travel accommodations during only the busiest moments in a specific city (i.e. during a major conference). But, it has since grown to become one of the most popular ways to book any accommodation (travel or otherwise). Airbnb accomplished this feat, in part, by focusing on delivering a “whole product” for its early hosts. For example, initially, growth was slow in New York. So, the founders went there to identify the problem. Although the accommodations were up to standards, the photos of the accommodations were terrible. So, they hired professional photographers to take pictures of the accommodations. This decision kick-started growth for the platform. Airbnb didn’t start off in the photography business, obviously, but in order to solve the needs of its initial early majority users, it created a “whole product” that incorporated a photography service. With decisions like this, Airbnb successfully crossed the chasm into the mainstream.

Bitcoin’s Crossing the Chasm Hurdle

As discussed in Part 1, for Bitcoin, overall, the initial adoption has been driven mostly by Bitcoin, the asset. Given the current point on the overall adoption curve along with the projected rate of adoption, it is clear that over the next 10 years, Bitcoin will start to move past those early adopters towards the early majority. To do so, Bitcoin will have to cross the chasm. The early majority, as risk-averse pragmatists focused on the day-to-day problems within their specific verticals, might struggle to grasp the narrative around Bitcoin as purely an investment asset. The early majority, when perceiving Bitcoin as exclusively an asset, will not comprehend how it can directly help them solve their day to day, vertical specific problems. So, in all likelihood, in order for Bitcoin to effectively cross the chasm, reach the early majority, and go mainstream, Bitcoin’s positioning will need to evolve. So, the pertinent question is: how will Bitcoin cross the chasm to reach the early majority?

To answer that question, let’s circle back to Moore who says the key to crossing the chasm is relentless focus on one specific market segment, a beachhead. Focus all resources on building a whole product for that specific segment. This strategy to cross the chasm does not fit neatly with most of the existing or previous narratives around Bitcoin. Those narratives encompass general use cases for broad swaths of the population. For instance, the narrative of a cheap payments network is exciting and interesting. Any business could use that, right? Well, given its broad scope, any business could use it. But, given the lack of a whole product incrementally solving a problem in a specific niche that just works, no business will use it. While early adopters don’t mind general narratives and half-baked use cases, the early majority will only adopt if there are specific use cases that incrementally solve their existing problems.

Bitcoin’s Crossing the Chasm Superpower

For Bitcoin to cross the chasm into the early majority, it will need to meet the unique needs of specific niche audiences who are focused on day to day problems within their business. These audiences want solutions that make their lives significantly easier and give them more time to focus on their core value propositions. If they’re pitched Bitcoin exclusively as an asset, based on their needs, they might not be compelled enough to explore and adopt. But, these early majority users could be very intrigued by the potential solutions enabled by Bitcoin, the network, or a better form of money.

Over the past few years, Bitcoin has developed a superpower in this race to cross the chasm. The Lightning Network will help transition Bitcoin from the early adopters who mostly use Bitcoin, the asset, to the early majority who will use Bitcoin, the network.

Before diving into that statement, let’s quickly zoom out and define the Lightning Network in the simplest terms possible. The Lightning Network is a software layer on top of Bitcoin that allows for instant, low fee, and high volume transactions. The network is based on a technology called payment channels. Payment channels allow for any two Bitcoin users to open up a channel with a defined amount of Bitcoin between themselves. Within a payment channel, these two users can exchange instant, nearly free payments with each other as long as the amount of Bitcoin in the channel meets their bi-directional payment needs. Lightning Network takes this technology and builds a network of payment channels in a fully decentralized, permissionless way. That network of payment channels allows for anyone on the network to pay someone else on the network in an instant, cheap way even if they don’t have a direct channel between them. For example, let’s say Alice wants to pay Bob. But, Alice doesn’t have a channel with Bob. However, she does have a channel with Carol who happens to have a channel with Bob. Alice can route the payment to Bob through Carol. And, because of cryptographic proof and the smart contracts inherent in the design of the Lightning Network, this transaction can occur without Alice needing to trust Carol.

It’s also important to highlight that the Lightning Network is a protocol layer built on top of the Bitcoin protocol. The Bitcoin protocol, powered by adoption of the early adopters, has become an almost trillion dollar, decentralized, global, always-on monetary network. So, the Lightning Network provides the ability to instantly, cheaply, and premissionlessly transact with Bitcoin, a nearly trillion dollar global monetary asset. And, the Lightning Network is completely open source. Anyone can contribute to it and anyone can build with it. Finally, as Lyn Alden discussed in her piece on Bitcoin network effects, the Lightning Network may have even stronger network effects than the Bitcoin base layer. The main constraint for the Lightning Network is liquidity. Namely, liquidity in the right places with a sufficient number of unique channels between unique nodes. As more and more liquidity is added and more channels are created and maintained, this will allow for more adoption, which kicks off a virtuous cycle.

So, Lightning Network is Bitcoin’s crossing the chasm superpower. It gives developers the ability to build on a stack that provides instant, cheap, and permissionless movement of value anywhere in the world at any time. With the Lightning Network and motivated entrepreneurs, Bitcoin, the network, unlocks the power of human ingenuity and optionality in its race to cross the chasm. It can harness the power of entrepreneurs to build compelling uses for niche audience segments leveraging a programmable, global and internet native money. These entrepreneurs will be able to use the open source protocol to solve their payment routing and cost needs. It provides Payment Infrastructure as a Service in the same way AWS provides Cloud/Hosting Infrastructure as a Service. So, instead of wasting valuable bandwidth solving a difficult general problem, entrepreneurs can focus on building useful tools for their specific audiences. With the Lightning Network, Bitcoin will get an almost infinite number of ‘shots on goal’ to build compelling products and use cases for the early majority.

The best historical example to demonstrate the power of human ingenuity and optionality in helping to cross the chasm comes from smartphones. In January 2005, RIM (Blackberry) reached 2 million subscribers marking a major milestone for smartphone adoption. However, it was only the very beginning of the adoption curve. RIM subscribers were the innovators. They were high-powered business people who needed to look at documents and send emails on the go. Then, the first iPhone launched in 2007 with the first Android phone coming a year later. The early iPhone and Android users were the early adopters. They saw the value in having the ability to listen to music, make calls, watch videos and access the internet over their mobile devices. But, smartphones didn’t actually reach the early majority of users until mid 2010. In order to get there, smartphones needed the launch of the App/Play Store in 2008/09. With that launch, developers were able to build on a stack that gave them a touch screen interface, internet connection, location data, and much more. Given that resource, developers built countless remarkable experiences that users wanted and, eventually, could not live without. The app ecosystem drove smartphones across the chasm into the early majority. The early majority didn’t need a smartphone to send emails or listen to music like the innovators or early adopters. But, they did need a way to get home from the bar (Uber). They did need directions to the new sushi restaurant to meet their friends (Maps). They did need a way to easily chat with friends who may not live in the same country (WhatsApp).

Potential Lightning Use Cases

So, what will early majority users need from Bitcoin, the network, an instant, cheap, global, always-on monetary network? Within just the past couple of years of development on Lightning, we’re starting to see glimpses of potential early majority use cases and solutions that might be just around the corner. I will outline just a few of those below. There are many more out there right now. And, even more to come that haven’t even been conceived of yet.

International Remittances

When someone from Country X wants to send money to a family member in Country Y, this is called an international remittance. International remittance payments cost, on average, 6.5% of the amount sent, with lower amounts actually requiring a higher percentage fee. Those prices can be even higher in countries with less formal financial infrastructure, which are often the places that most need remittances due to inflationary pressures and stagnant economies. Even at that cost, international remittances can take anywhere from days to a week to process.

On Lightning Network, Strike has built a product that allows users to send money instantly, with no fees, anywhere in the world. So, you can take dollars from your account in the United States and send that directly to a user in the UK who receives that money in pounds instantly with no fees. This transaction is possible because the USD is instantly converted to BTC sent to the UK and instantly converted back to GBP.

With this product, Strike immediately solves a real problem for millions of users. That’s a fact, not a hypothesis. In the past two months, Strike launched in El Salvador, the sixth highest ranked country in inbound remittance from the United States. 24% of the nation’s entire GDP is remittance based. After Strike’s launch, it became the #1 most popular app in the country after only 3 weeks. These users are using Bitcoin + Lightning, even if they don’t know it.

Card Rewards

Credit card companies use points as a user acquisition mechanism with the promise that the more you spend, the more reward points you’ll receive, which can be used for travel, experiences, and more. However, the industry’s dirty little secret is that ‘your’ points are at risk of inflation, devaluation, and, even, cancellation.

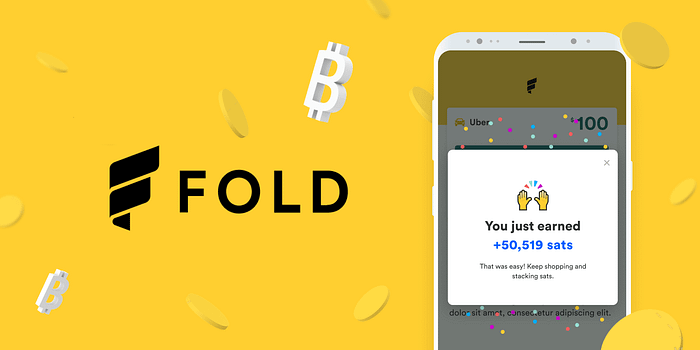

Enter Fold. Fold allows for users to earn Bitcoin on all of their spending. Rather than accumulating transitory credit card points, users are able to stack hard money with every single purchase. Just in the past few months, Fold has processed over $100M worth of transactions and distributed billions of satoshis to its users. And, in the future, they will launch a Bitcoin Rewards API so that other card companies can create credit cards which allow for users to receive Bitcoin back rather than points.

Creator Economy: Value for Value

In the tech and venture capital world, the creator economy has been a hot sector for years. Recently, Li Jin of Atelier Ventures, a prominent thought leader in this space, posted the following, which suggests that platforms impose an egregious tax on their most valuable users, those that create the content.

Platforms are able to impose these take rates because of their monopoly on user attention. That monopoly on user attention is driven in part by the creators of the content, but also, by the user needs around content discovery and the user unwillingness to pay for broad access to content. As creators grow their followings on these platforms, they are increasingly finding better ways to monetize those users off the platform through tools like Patreon or Substack. So, despite not being willing to pay for the initial discovery platform, once fans find their creators, they are willing to pay for content from that specific creator. That said, price discovery is still ongoing with regard to what fans are willing to pay creators for each type of content.

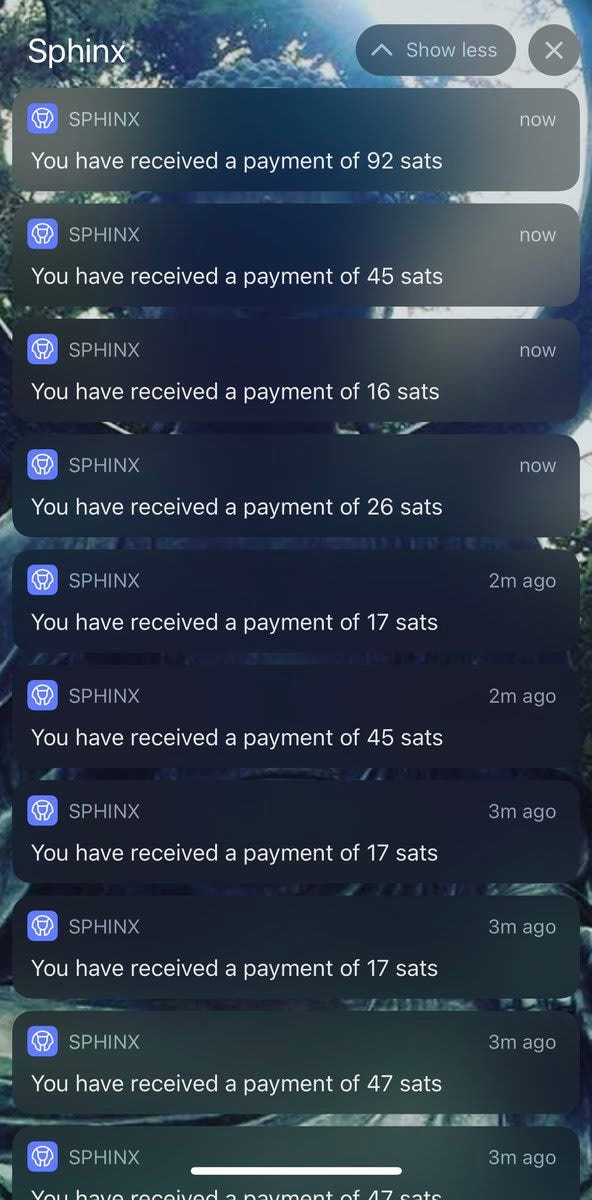

On Lightning Network, Sphinx.chat built a product which allows for creators to receive micropayments when they chat with or podcast for their fans. For podcasts, podcasters can set the cost of listening to each episode at a certain number of sats per minute. Additionally, users can tip additional sats while they listen. By creating this product with Bitcoin and Lightning, the payments can be extremely small (micropayments aren’t possible in the legacy financial system). So, users can tip as granularly as they want and hosts can set a very low cost per listen. And, creators can grow their paid following beyond their own borders as they don’t have to manage currency conversion. As the size of the audience builds, the streaming sats paywall along with tipping could actually drive meaningful revenue for creators. Users and creators could build a value-for-value model where users pay directly for the content itself. If this model gets traction amongst creators, it could start to crack the existing internet content model around monopolizing user attention and relying on ads to deliver value back to content creators.

Gaming + Metaverse

Since the invention of digital gaming, games have tried to mimic the use of money by creating unique tokens that can be earned in the game and exchanged for in-game products. Roblox is one of the most well known examples of such an experience. Games created these tokens as a way to reward users and encourage them to purchase status in the game (outfits, tools, weapons, etc.). In this way, countless games have built up these walled garden economies. Even though it would potentially drive more engagement, games are not able to incorporate real money into their experience due to the costs associated with transferring that money between players and from the game to the players.

On Lightning Network, Zebedee has built a platform which allows for game developers to incorporate real Bitcoin payments into their experience. Instead of points with no value outside of the walled garden of their games, game developers can easily incorporate Bitcoin payments. This platform allows for developers to add real skin in their game, which can make the experience much more engaging for end users.

Earning Sats

Stakwork is a Lightning based platform for permissionless microtasks. Through the platform, anyone, anywhere can accomplish small tasks and get paid in Bitcoin. In the last 6 months, workers on Stakwork have been paid for 3M tasks, totaling 171,000 Lightning payments. They have 20,000 workers onboarded in places like Argentina, Nigeria, Ghana, Turkey, and the Philippines with a waiting list about as long.

Real Time VPN

Impervious built a dynamic Lightning based VPN, currently in closed beta. Impervious generates cryptographically secure tunnels that ensure data remains private both at rest and during transit, while also shielding the source of data transmissions.

Bitcoin + Lightning Network = A Bet on Human Ingenuity

When the App Store launched, no one immediately knew that Uber, Doordash, SnapChat and Instagram were going to make smartphones irreplaceable. No one knew which specific experiences would resonate with end users in the early majority. But, Apple and Android bet on the power of human ingenuity to figure out compelling use cases on top of this new, powerful tech stack.

We find ourselves in a similar position with Bitcoin today. Bitcoin, the asset, has kickstarted the adoption curve of Bitcoin overall. And thus, we’re rapidly approaching the crossing the chasm moment. Bitcoin, the network, will help Bitcoin evolve to solve the specific problems of the early majority. The Lightning Network gives Bitcoin the superpower of relying on human ingenuity and optionality to do that. It lets developers and entrepreneurs build on top of a global, always-on, permissionless nearly trillion dollar network to create compelling products for their niches. What will those hit products be? No one knows. But, I’m betting on Bitcoin + Lightning Network. Because, at this point, that’s just a bet on human ingenuity.